SYNOPSIS:

How today's Treasury lies with numbers, part CCCLVI:

The following letter appeared in today's Times:

As the former Deputy Assistant Secretary responsible for tax analysis

at

the Treasury Department I must respond to Mr. Krugman’s recent column

(August 5, 2003) accusing political bias.

The Treasury does detailed analysis of tax legislation and has reported

many of these analyses on its web site. The Treasury Department

also

frequently responds to requests by the media for analysis.

Mr. Krugman objects to an analysis that showed the effects of the

2001 and

2003 tax cuts for six representative families. Among the six

representative families, the analysis provided an example of a married

couple, both spouses aged 65, with $40,000 in income, including

$2,000 in

dividend income. Mr. Krugman objects that such a family is not

representative of elderly taxpayers. Obviously, no single example

can be

representative of all elderly taxpayers, but the example is useful

precisely because it is unlikely to be misinterpreted - it applies

to the

couple described. Further, this couple has income quite close to

the

median for such filers, their $2,000 in dividends is quite close

to the

average amount of dividends for elderly filers at their income level,

about

half of which have dividend income. As a result, the elderly couple

Mr.

Krugman objects to is quite representative of such income tax filers.

The

example couple has seen a decline in its income tax liability from

$1,396

to $675 as a result of the 2001 and 2003 tax cuts.

Mr. Krugman is certainly free to oppose the tax relief provided to

the

taxpayers described in these examples but he should be more circumspect

in

asserting political bias in the underlying analyses.

Andrew B. Lyon

College Park, MD

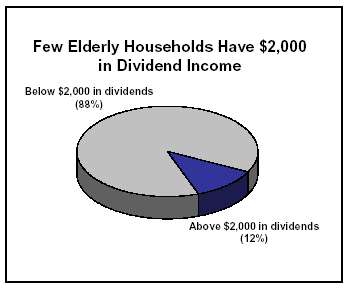

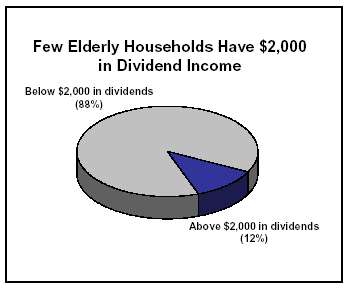

Did you get that? I'm more accustomed to this sort of math than 99 percent of readers, and it took me about 6 reads. The average dividend of elderly families with the median income, half of whom receive dividends ... it sounds as if this refutes what I said . But you'll notice that he never takes on my assertion that only about 1/4 of elderly families receive any dividends, which comes from Tax Policy Center ; nor does he challenge my statement that only 1 in 8 elderly households receive as much as $2000 in dividends, which comes from CBPP . Here's CBPP's picture:

I leave it as an exercise for readers to figure out how Lyon's discussion is consistent with a real world in which the Treasury's "low-income" elderly household has more dividend income than 7 out of 8 elderly households.

The point, however, is that the confusing discussion shows the Treasury strategy at work. 1. Never answer the question directly. 2. Offer an elaborate calculation that sounds as if it refutes the accusation that the tax cut mainly favors the wealthy, when in fact it does no such thing.

For afficionados: notice how they're still doing the average/median thing. It's clear from what he says that the median dividend for families with the median income is ... 0.

Update: I couldn't provide a direct link to the piece from Tax Policy Center, because their web site appears to be down today. But here is a good summary table from Citizens for Tax Justice. By the way, both CTJ and TPC basically have the Treasury model of tax impacts, so their numbers must correspond very closely to what Treasury knows but won't tell us. For more about all this, read Sullivan's angry article in Tax Notes.

Originally published on the Official Paul Krugman Site, 8.9.03